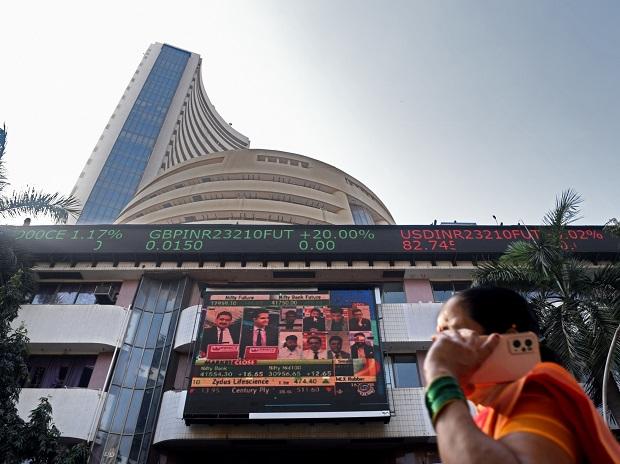

The benchmark Sensex fell half a per cent after the US Federal Reserve raised interest rates by 25 basis points (bps) – the ninth straight hike since March 2022 – to curb stagnant inflation in the world’s largest economy.

The latest hike – which has raised rates from near zero last year to 4.75-5 per cent, the highest since 2007 – came despite turmoil in the banking sector.

Market losses were capped as investors bet the Fed raised rates despite no such signal from the US central bank. The benchmark Sensex ended the session down 289 points, or 0.5 per cent, at 57,925. The Nifty closed at 17,077, down 75 points or 0.4 per cent.

Foreign portfolio investors pulled out nearly Rs 1,000 crore from domestic stocks on Thursday, while domestic institutions bought Rs 1,668 crore.

Markets are “encouraged by the Fed’s less aggressive stance and the perception that the central bank will sharply reverse course on interest rates. While Powell pushed against it, markets had other ideas and it took the dollar to soften, yields to pull back.” And enabled gold to rally,” said Craig Erlam, senior market analyst at Oanda.

The Bank of England (BoE) joined the US and Norway to hike rates by 25 bps in the face of persistently high inflation.

Norges Bank on Thursday raised its benchmark deposit rate by 25 basis points to 3 per cent, the highest level since 2009, signaling further tightening against higher price pressures.

Experts said central banks globally have the delicate task of balancing inflationary expectations and ensuring financial stability.

Investors are betting on a rate cut later in the year. A section of the markets is forecasting a fall in Fed rates to 4.1 per cent by December.

Fed chief Jerome Powell himself said he does not expect a rate cut this year and will raise it further if needed.

“Domestic equities swing between gains and losses after the US Fed continued with its rate hike trajectory. The statement by the Treasury Secretary not to provide blanket insurance to all banks dampened sentiments. The US Fed gave the market a did little to provide concrete direction. Their resolve to contain inflation remains strong despite the ongoing banking turmoil,” said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services.

The overall market breadth was negative with 1,379 scrips gaining and 2,137 scrips declining. Shares of Reliance Industries fell 1.3 per cent and Sensex lost 88 points. SBI declined the most among Sensex constituents at 1.7 per cent. FMCG stocks gained on demand as a safe investment option.

Shrikant Chauhan, Head of Equity Research, said, “For bulls, 17,050-17,000 will act as an important support zone, while 17,200-17,250 could act as a major resistance zone for short-term traders. However, below 16,950, the uptrend will weaken ” In Kotak Securities.