In the chart, the price bars frequently create recognisable patterns. The traders use them to forecast the price of the underlying asset in the future so they can initiate trading. Different patterns require different levels of complexity. I’ll describe today’s pattern, which consists of simply one candlestick. The Belt Hold is the name of it. In Japanese, it is also known as yorikiri.

In the chart, the price bars frequently create recognisable patterns. The traders use them to forecast the price of the underlying asset in the future so they can initiate trading. Different patterns require different levels of complexity. I’ll describe today’s pattern, which consists of simply one candlestick. The Belt Hold is the name of it. In Japanese, it is also known as yorikiri.

The belt hold candlestick pattern

One Japanese candlestick can be used to create the candlestick pattern known as the belt hold. Both an uptrend and a decline can contain it. It offers details on a potential reversal of the current trend.

When the candle in a different colour emerges, the belt hold candlestick design may be recognised. On the price chart, it can appear rather frequently, hence it is not regarded as being very dependable. To be able to forecast trends, you need practise for at least a few days.

The pattern closes inside the previous candle’s body, seemingly preventing price movement in the prior direction. The pattern’s name is derived from this.

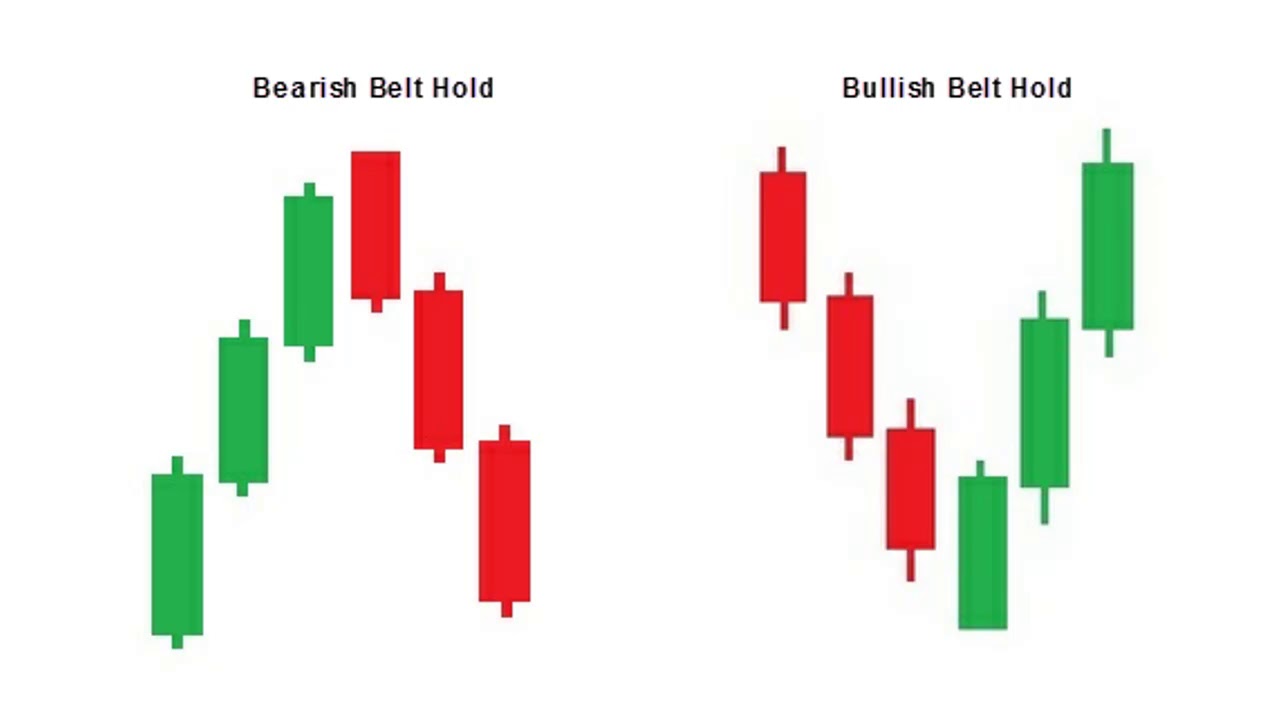

There are two distinct belt hold pattern kinds. Both bullish and bearish belt holds are present.

The bearish belt hold pattern

When there is an upward trend on the price chart, the bearish belt hold candlestick pattern occurs.

The following requirements must be met for the bearish belt hold pattern to be valid:

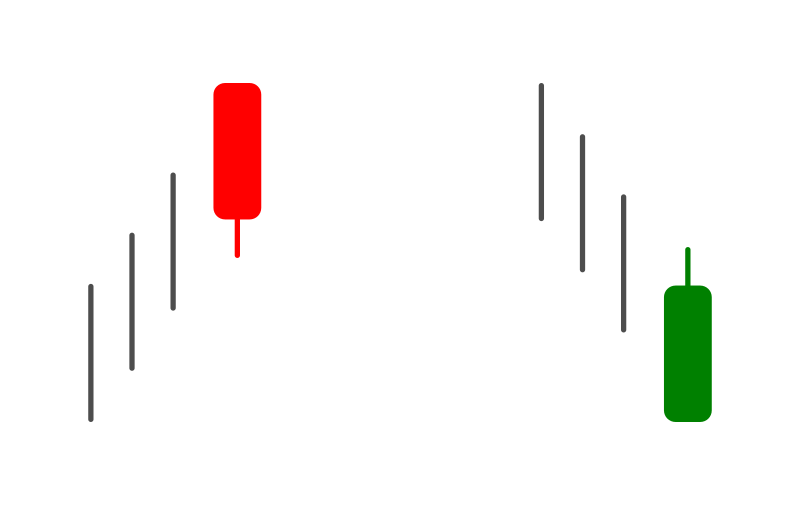

After several bars of bullish trading, a bearish candlestick will arise; its opening will be higher than the closing of the previous bar. The lower wick of the belt hold candle is short, the upper wick is either absent or extremely small, and the opening price on the intraday chart may be comparable to the previous closing price.

The bearish belt hold pattern foretells a change in trend. The price chart makes it fairly simple to spot, but keep in mind that this is a regular pattern and should only be traded with care. By examining the preceding candle, you may verify the pattern. It ought to have a long bullish trend. There must be a long red belt hold bar. In order to validate the indication, the candlestick that forms immediately after should likewise be bearish.

The candlestick pattern with a bullish belt holds

As the price of the underlying asset declines, the bullish belt hold pattern develops. It implies that a trend reversal could occur.

It can be seen in any timeframe, though the daily or weekly charts show it more clearly.

How can the bullish belt hold pattern be located?

There was a downward trend in the market, and after several bearish candles, a bullish candle forms. On the intraday chart, this bullish candle’s opening is lower than its closing, and its body should be lengthy with a thin wick at the top and no wick at the bottom (or with merely visible wick).

When it appears near the support level, the bullish belt hold pattern has greater strength.

You can use a local top that was a belt hold pattern in the future as a degree of resistance if you find one. See the image below. Of course, local bottoms with belt patterns fall under the same restrictions. These could serve as degrees of potential support.

Summary

A single Japanese candlestick creates the belt hold pattern. When it emerges during an upward movement, it is known as a bearish pattern, and when it appears during a downward trend, it is known as a bullish belt hold pattern.

The belt hold is a reversal pattern, therefore you can anticipate that when it appears, the price will shift.

The reliability of this candlestick pattern is not very good because it happens frequently. Using extra technical indicators or different price patterns is a good idea.

Utilize the Quotex demo account to practise. You can follow the pattern’s evolution and the price’s subsequent movement without putting your own money at risk. You can switch to the live account once you have mastered using the belt hold candlestick pattern in trading.