The Alligator indicator is a technical analysis tool developed by Bill Williams to help traders identify trends and potential trading opportunities in the financial markets. The indicator consists of three moving averages, each representing a different time period, and is designed to show the direction and strength of a trend. In this article, we will discuss the Alligator trading strategy, how to use the Alligator indicator in Forex and binary options trading, its calculation, working mechanism, best settings, time frame, reading techniques, accuracy, reliability, and combination with other indicators, as well as an Alligator scalping strategy.

Calculation of the Alligator Indicator

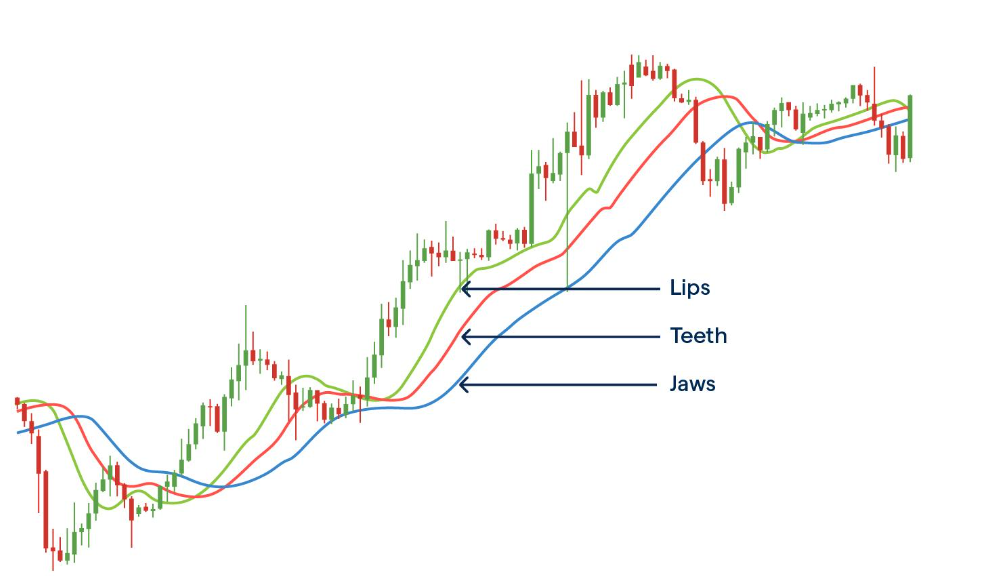

The Alligator indicator uses three smoothed moving averages, also known as the jaw, teeth, and lips. The periods for the moving averages are typically 13, 8, and 5, respectively. The formula for the jaw is (high + low) / 2, shifted 8 bars into the future. The formula for the teeth is (high + low) / 2, shifted 5 bars into the future. The formula for the lips is (high + low) / 2, shifted 3 bars into the future. The Alligator indicator is then overlaid onto the price chart, with the jaw, teeth, and lips represented by a blue, red, and green line, respectively.

How does the Alligator Indicator work?

The Alligator indicator works by showing the relationship between the moving averages and the price action of an asset. When the three lines are intertwined, it indicates that the asset is in a range-bound market, with no clear trend. When the three lines are diverging, it indicates that the asset is in a trending market, with a clear direction. The Alligator indicator also uses the concept of fractals, which are patterns that repeat themselves at different scales, to identify potential support and resistance levels.

How to Use the Alligator Indicator in Forex Trading

In Forex trading, the Alligator indicator can be used to identify trend reversals and potential entry and exit points. When the three lines are tightly intertwined, it indicates that the market is range-bound and that traders should avoid taking positions. When the lines start to diverge, it indicates that the market is trending, and traders should look for opportunities to enter or exit positions. Traders can also use the Alligator indicator to identify potential support and resistance levels, by looking for areas where the price action intersects with the lines.

What is the Best Time Frame to Use the Alligator Indicator?

The best time frame to use the Alligator indicator depends on the trader’s trading style and goals. For longer-term traders, such as swing traders and position traders, the daily or weekly time frames are usually the most appropriate. For shorter-term traders, such as day traders and scalpers, the 1-hour, 30-minute, or 15-minute time frames may be more appropriate.

How to Use the Alligator Indicator in Binary Options Trading

In binary options trading, the Alligator indicator can be used to identify potential entry and exit points for binary options trades. Traders can look for divergences between the Alligator indicator and the price action, as well as potential support and resistance levels. Traders can also use the Alligator indicator to identify trend reversals and potential breakouts.

What is Alligator Indicator Accuracy?

The accuracy of the Alligator indicator depends on various factors, including the time frame, market conditions, and the trader’s skill and experience. Like any technical analysis tool, the Alligator indicator is not infallible and should be used in conjunction with other indicators and fundamental analysis to make informed trading decisions.

Are Alligator Indicators Reliable?

The reliability of the Alligator indicator depends on how it is used and in what market conditions. When used in a trending market, the Alligator indicator can be highly reliable, as it helps traders identify the direction and strength of the trend. However, in a range-bound market, the Alligator indicator may not be as reliable, as the three lines may become intertwined and give false signals.

It is also important to note that the Alligator indicator is a lagging indicator, which means that it may not be as useful in predicting future price movements as other leading indicators. Therefore, it is important for traders to use the Alligator indicator in combination with other technical indicators and fundamental analysis to increase its reliability.

Best Alligator Indicator Settings

The best Alligator indicator settings may vary depending on the trader’s trading style and the market conditions. However, the default settings of 13, 8, and 5 for the jaw, teeth, and lips, respectively, are a good starting point. Traders can experiment with different settings to find what works best for them.

How to Read Alligator Indicator

To read the Alligator indicator, traders should look for the relationship between the three lines and the price action. When the lines are intertwined and close together, it indicates a range-bound market with no clear trend. When the lines start to diverge, it indicates a trending market with a clear direction. Traders should also look for potential support and resistance levels where the price intersects with the lines.

Alligator Indicator Combination

The Alligator indicator can be used in combination with other technical indicators to increase its reliability and accuracy. Some popular indicators to use in combination with the Alligator indicator include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the Bollinger Bands.

Alligator Scalping Strategy

The Alligator scalping strategy is a short-term trading strategy that uses the Alligator indicator to identify potential entry and exit points for quick trades. Traders using this strategy typically use the 5-minute or 1-minute time frames and look for trends that are just starting to form. The strategy involves entering a trade when the three lines of the Alligator indicator start to diverge and exit the trade when the lines start to converge. Traders using this strategy should be prepared to exit their trades quickly and have a tight stop loss in place to limit their losses.

Conclusion

The Alligator trading strategy is a popular technical analysis tool that can be used in Forex and binary options trading. By understanding how to use the Alligator indicator, traders can identify potential trends and entry and exit points, as well as potential support and resistance levels. However, it is important to remember that no technical indicator is infallible and should be used in combination with other indicators and fundamental analysis to make informed trading decisions.