One of the best trading interfaces is available on the Pocket Option platform. It includes several features that will aid you in your trading profession and is made to be simple to use. The simplicity of usage is, in my opinion, the best feature of the Pocket Option platform. People who have used other platforms before will be able to use a simplified platform in just a few seconds. In this manual, we’ll demonstrate how to use each component of the trading interface for Pocket Options.

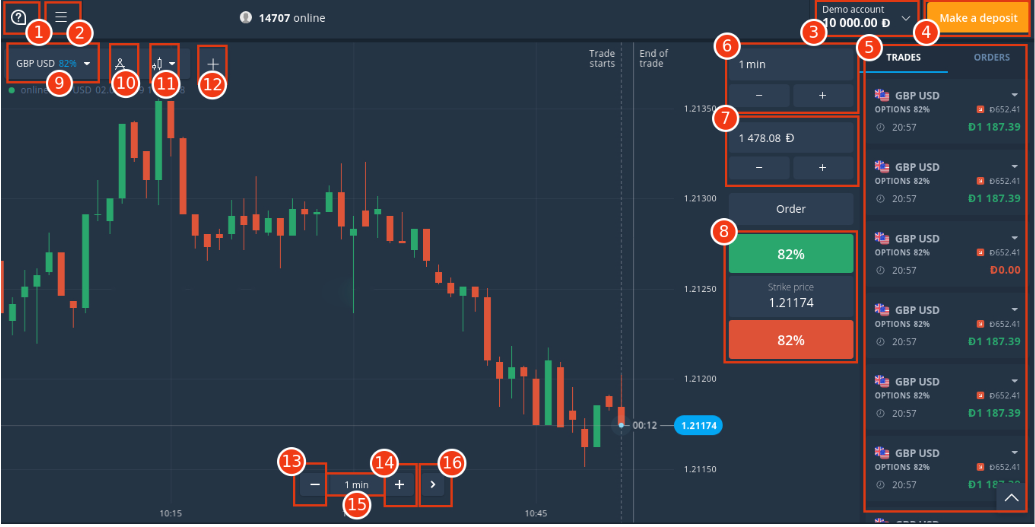

You can see the numbers that correspond to the features of the platform that will be covered in more detail on the screenshot below. However, take in mind that your screen resolution, window size, and other settings will affect where some icons and sections appear.

Help Section (1)

You may access the Help menu by clicking on the question mark in the top bar or the top of the left sidebar. From there, you may engage in support chats and watch a ton of video courses that show you how to use new trading tools and techniques in addition to the platform. Additionally, a virtual assistant is available to answer your most often inquiries regarding how the Pocket Option platform functions and how to conduct technical analysis. If you are a VIP, you can get trade signals that are personalized for you here.

Main Menu (2)

You can access the Pocket Option platform’s main menu by clicking the “hamburger icon”. You may manage your account from this point on, making deposits and withdrawals, viewing previous transactions, updating your personal information, and viewing historical prices of any asset. Here, you can also go to a different trading platform to trade CFDs or financial derivatives, often known as currency pairings. You may simply acquire the Pocket Option resources you need from this page, including the economic calendar, trading alerts, and educational materials.

Account Balance (3)

You can see how much money is currently in your account in the upper right corner of your screen. You can switch between your real account and your demo account with this.

Deposit (4)

The deposit button has an obvious purpose. Your real or practice account can accept deposits.

Trading Activity Section (5)

The Trading Activity area can be found on the platform’s right sidebar or towards the bottom. Trades and Orders are two of its tabs. You may monitor your open positions and view the results of your previous trades from the “Trades” tab. You may get information about your pending orders under the “Orders” tab. Trades and executed orders are connected, making it simple to track what transpired with a trade.

Business Management (6, 7, 8)

You can set up your trade here in pieces. To trade financial derivatives, you must select the expiration time (number 6), the deal size (number 7), and the anticipated direction of the market (number 8; green for high, red for low). You can predict whether you believe the market price will be greater or lower than the strike price, which is in between, by using the High and Low buttons.

Charting Features (9, 10, 11, 12)

The upper left corner of the chart area contains all of the charting tools. From there, you may select and view the assets to trade (9). You can access a number of technical indicators and drawing tools by clicking on the compass symbol (10) on the toolbar. They can be used to aid in market analysis. The change in chart type is the following (11). You can select the kind of chart that best suits your needs. Here are the most typical methods for showing price information on a timeline: Heiken Ashi, Bars, Japanese Candlesticks, and Area (Line Chart). You can view many devices at once with the plus sign (12). Other charts can be used to view a market across a variety of time frames. The 15-minute EURUSD chart, for instance, can be used to identify a trend higher while trading EURUSD from the 5-minute time frame.

Chart Navigation (13, 14, 15, 16)

There is a little section with buttons to let you navigate the chart at the bottom, in the center of your chart. On the graph, you may zoom in or out (13, 14), and you can also vary the time range from 15 seconds to 1 month (15). You might wish to rapidly return to the current candle if you previously examined the market by dragging back the charts. The price’s current trend can then be displayed on the chart using the right chevron icon (16).

Different views of the trading interface

I hinted at the possibility of different locations for some user interface components at the outset of this post. You will comprehend how the Pocket Option platform functions more when you use it more frequently. As time passes, you will be able to make some adjustments. When you trade CFDs (currency pairs), the trade management area will appear slightly different. There won’t be a time limit, but you’ll have more resources to use the stop loss/take profit and leverage (multiplier) capabilities.

You must now be familiar with and adept at using the Pocket Option trading interface. Use the comment area below to ask any queries or to share your thoughts on the Pocket Option user interface.

The post “Pocket Option Platform: A Quick and Easy Guide to Navigating the Trading Interface” appeared first on Pocket Option.