On the Pocket Option platform, there is a tool called Trendline that is quite helpful. Its main objective is to monitor trends and price fluctuations. Since this tool is a graphic, it won’t show up on its own. You must carry it out on your own. However, applying trendlines is not as challenging as it might initially appear. You’ll become an expert quickly using this guide.

We’ll demonstrate how to use trendlines when trading an uptrend, but the concept also applies to downturn trading. Simply adhere to the guidelines we have provided here.

As we’ve already mentioned, the purpose of establishing a trend line is to track variations in price. However, it only functions in the current situation. It was intended to join lower lows and higher highs in an upward trend. Talking about lows and highs makes sense when discussing a downward trend. Let’s now discuss essential words.

Uptrend – Basic terms you may need to be familiar with.

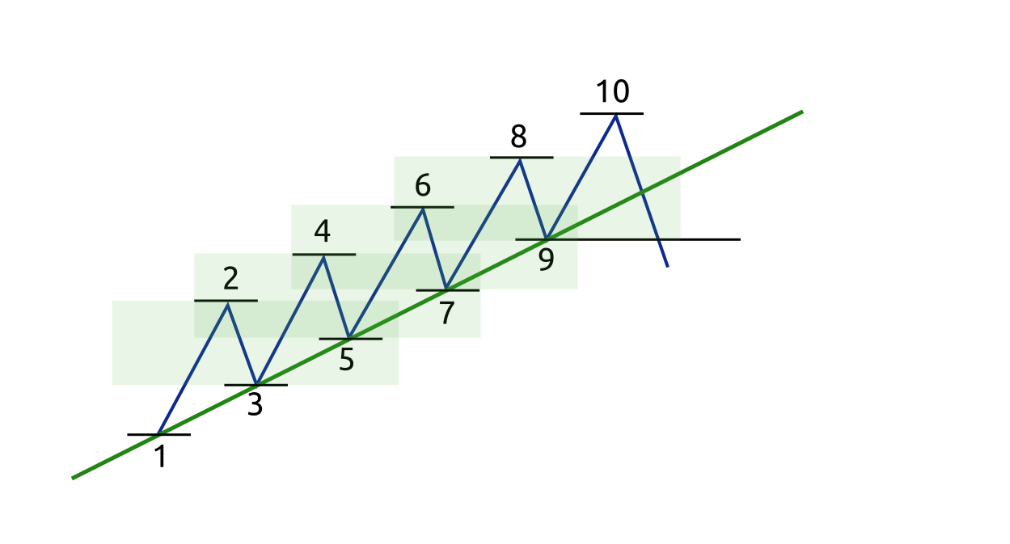

Acceleration Force -The first thing you need to comprehend is this. As a result, prices are going up. On the chart, long bullish candles show that the bulls are in control of the market (green). The peaks’ heights rise in tandem with rising costs. You can notice that peaks 2 and 4 increase in height from left to right in the following image.

Reform Movement The sellers are not inactive just because there is an uptrend. They actually make constant efforts to lower pricing. And this causes price alterations. Prices will need to decrease once they have control of the market. This is what the “reform movement” entails. However, buyers will soon enter and take control of the market. The prices will rise as a result once more.

The correction’s momentum can be seen between points 2 and 3 in the diagram that follows. The momentum at the height of the buying season is represented by the number 2. Despite this, dealers are close by and are reducing their prices up till point 3. Buyers continue to act during this time, and finally the price shifts once again, increasing to point 4.

Remember that every trend will eventually experience a correction movement. There are some bearish candles interspersed with bullish ones when we are seeing an uptrend. These zones of correction serve as places of support and resistance during trends.

How to use trendlines when trading on the Pocket Option platform.

Before using a trendline, you must first draw one on the chart. You must first access the Japanese candle chart in order to do this. Pick out minutely burning candles. Then, from the list of graphical tools, select Trendline. You can now sketch your trendline, as seen in the diagram below.

When is the best moment to enter a trade using the trendline on Pocket Option?

See chart below.

The peaks, which are 2, 4, 6, 8 and 10, show that the trend is upward. You are aware that they are advancements. The cost decreases a little before rising again. It is not a smart idea to start trading at these levels. You would need to sell as a result, but the trend is still upward.

The greatest times to purchase are on points 3, 5, 7, or 9 when the cost is really low. You should keep in mind that the trend will probably shift at some time in the future. Your trading positions should grow more short-term as the trend develops. As a result, entering a position at point 3 should result in a significantly longer-lasting long position than entering at point 5 or 7.

You can utilize trendlines to assist you in achieving your objectives. They can be arranged on a chart very easily. They will assist you in determining the validity of a trend.

Use this tool right immediately on your Pocket Option sample account. You’ll be prepared to utilize it with real money once you’ve used it a few times. Because there are no assurances in trading, just proceed with extreme caution. Please keep in mind that we would love to hear from you, regardless of whether you had any problems receiving it or did.