When it comes to technical analysis in trading, the Simple Moving Average (SMA) is one of the most widely used indicators. Traders use SMA to determine trend direction, identify potential entry and exit points, and predict potential price movements. In this article, we will explore how SMA works, how to use it in trading, its limitations, and some frequently asked questions.

How do you use SMA indicator?

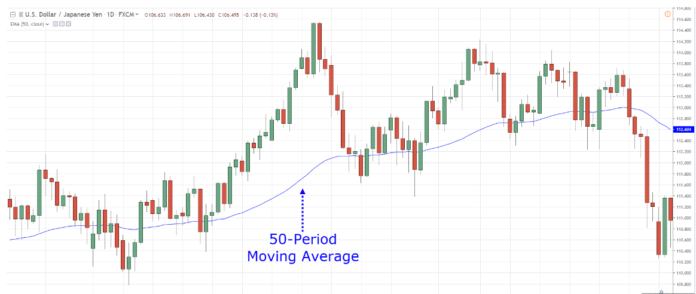

The SMA is calculated by taking the average price of a security over a specified number of periods, such as 10, 20, or 50. The result is a line that represents the average price of the security over that time period. Traders typically use two or more SMAs, each with a different time period, to get a clearer picture of the trend direction.

Traders use SMA to identify the trend direction. When the price of a security is above the SMA, it is considered to be in an uptrend, while when the price is below the SMA, it is considered to be in a downtrend. Traders also use SMAs to identify potential entry and exit points. For example, when the price of a security crosses above the SMA, it may signal a buy signal, while when the price crosses below the SMA, it may signal a sell signal.

Understanding SMA

The SMA is a simple and straightforward indicator that is easy to calculate and interpret. It is calculated by taking the sum of the closing prices over a specified number of periods and dividing by the number of periods. For example, to calculate a 10-day SMA, you would add up the closing prices of the past 10 days and divide by 10.

Formula for SMA

SMA = (Sum of Closing Prices for n periods) / n

Special Considerations

While the SMA is a useful indicator, it has some limitations. For example, it is a lagging indicator, which means that it may not be able to predict sudden price movements. Additionally, because the SMA gives equal weight to all data points, it may not be able to capture the significance of recent price movements.

Exponential Moving Average

One alternative to the SMA is the Exponential Moving Average (EMA), which gives more weight to recent price movements. The EMA is calculated by taking a weighted average of the closing prices over a specified number of periods, with more weight given to recent prices. While the EMA can be more responsive to sudden price movements, it can also be more volatile.

Moving Average Strategy for Intraday, Forex, Swing Trading, Binary Options, and Crypto

The moving average strategy can be used in various types of trading, including intraday, forex, swing trading, binary options, and crypto. The strategy involves using one or more SMAs to identify trend direction, entry and exit points, and potential price movements.

For example, in intraday trading, traders may use a combination of SMAs, such as a 5-day SMA and a 20-day SMA, to identify short-term trend direction and potential entry and exit points. In swing trading, traders may use longer-term SMAs, such as a 50-day SMA and a 200-day SMA, to identify longer-term trend direction and potential entry and exit points.

Best SMA for Day Trading, Crossover Strategy, and 1 Minute Chart

The best SMA for day trading, crossover strategy, and 1 minute chart will depend on the specific trading strategy and the market being traded. However, some common SMAs used in trading include the 10-day SMA, 20-day SMA, 50-day SMA, and 200-day SMA.

What are Simple Moving Average Examples?

Simple moving average examples include a 10-day SMA, 20-day SMA, or

complex examples such as a combination of a 50-day SMA and a 200-day SMA. For instance, a 10-day SMA would take the average closing price of the past 10 trading days, while a 20-day SMA would take the average closing price of the past 20 trading days.

Limitations of SMA

While SMA can be a useful indicator, it has some limitations that traders should be aware of. As a lagging indicator, it may not be able to predict sudden price movements. Additionally, because it gives equal weight to all data points, it may not be able to capture the significance of recent price movements.

SMA vs EMA

SMA and EMA are both moving averages, but they differ in how they weight data points. SMA gives equal weight to all data points, while EMA gives more weight to recent data points. As a result, EMA is more responsive to sudden price movements, but it can also be more volatile than SMA.

SMA vs WMA

SMA and Weighted Moving Average (WMA) are both moving averages, but they differ in how they weight data points. SMA gives equal weight to all data points, while WMA gives more weight to recent data points. However, unlike EMA, WMA uses a weighting scheme that assigns a weight to each data point based on its position in the series.

Simple Moving Average FAQs

Q: What is the difference between SMA and EMA?

A: SMA and EMA differ in how they weight data points. SMA gives equal weight to all data points, while EMA gives more weight to recent data points.

Q: How do you calculate SMA?

A: SMA is calculated by taking the sum of the closing prices over a specified number of periods and dividing by the number of periods.

Q: What is the best SMA for day trading?

A: The best SMA for day trading will depend on the specific trading strategy and the market being traded, but some common SMAs used in day trading include the 10-day SMA and 20-day SMA.

Q: What are some limitations of SMA?

A: SMA is a lagging indicator, which means that it may not be able to predict sudden price movements. Additionally, because it gives equal weight to all data points, it may not be able to capture the significance of recent price movements.

In conclusion, the Simple Moving Average is a widely used technical analysis indicator that can help traders identify trend direction, potential entry and exit points, and potential price movements. However, traders should also be aware of its limitations and consider using other indicators or strategies in conjunction with SMA to make informed trading decisions.

Moving Average Strategies for Intraday, Forex, Swing Trading, Binary Options, and Crypto

Moving averages can be used in a variety of trading strategies for different types of markets and timeframes. Here are some examples:

Moving Average Strategy for Intraday: Intraday traders may use short-term moving averages, such as the 10-day or 20-day SMA, to identify short-term trends and potential entry and exit points. For example, if the price is above the SMA, it may be a bullish signal, while if the price is below the SMA, it may be a bearish signal.

Moving Average Strategy for Forex: Forex traders may use a combination of SMAs, such as the 50-day and 200-day SMAs, to identify long-term trends and potential entry and exit points. For example, if the price is above both SMAs, it may be a bullish signal, while if the price is below both SMAs, it may be a bearish signal.

Moving Average Strategy for Swing Trading: Swing traders may use a combination of SMAs, such as the 20-day and 50-day SMAs, to identify medium-term trends and potential entry and exit points. For example, if the shorter-term SMA crosses above the longer-term SMA, it may be a bullish signal, while if the shorter-term SMA crosses below the longer-term SMA, it may be a bearish signal.

Moving Average Strategy for Binary Options: Binary options traders may use short-term SMAs, such as the 5-day or 10-day SMA, to identify short-term trends and potential entry and exit points. For example, if the price is above the SMA, it may be a bullish signal, while if the price is below the SMA, it may be a bearish signal.

Moving Average Strategy for Crypto: Crypto traders may use a combination of SMAs, such as the 20-day and 50-day SMAs, to identify medium-term trends and potential entry and exit points. For example, if the shorter-term SMA crosses above the longer-term SMA, it may be a bullish signal, while if the shorter-term SMA crosses below the longer-term SMA, it may be a bearish signal.

Best SMAs for Day Trading, Crossover Strategy, and 1-Minute Chart

The best SMAs for day trading, crossover strategy, and 1-minute chart will depend on the specific trading strategy and the market being traded. However, some common SMAs used in these contexts include:

Best SMA for Day Trading: The best SMA for day trading will depend on the specific trading strategy and the market being traded, but some common SMAs used in day trading include the 10-day SMA and 20-day SMA.

Best SMA Crossover Strategy: The best SMA crossover strategy will depend on the specific trading strategy and the market being traded, but some common SMAs used in crossover strategies include the 50-day and 200-day SMAs.

Best SMA for 1-Minute Chart: The best SMA for a 1-minute chart will depend on the specific trading strategy and the market being traded, but some common SMAs used in this context include the 5-day and 10-day SMAs.

Understanding and using Simple Moving Average can be an effective tool in a trader’s toolbox, whether it’s for intraday trading, forex, swing trading, binary options, or crypto. With its various uses and applications, it is important to understand its formula, limitations, and how it compares to other moving averages, such as EMA and WMA. As with any trading tool, it is important to use it in conjunction with other indicators and strategies to make informed trading decisions.