Money management is one of the key components of maintaining good options trading. You want to reduce trade losses and boost winning trades. In this approach, winning transactions will balance out lost ones, giving you some profit.

Long-term trading, however, depends on changing your trade to reflect the capital that remains after a loss. After a loss, you should rationally reduce the amount you put on transactions. Yet one tactic suggests doing the reverse. The Martingale strategy issue this.

How does the Martingale strategy work?

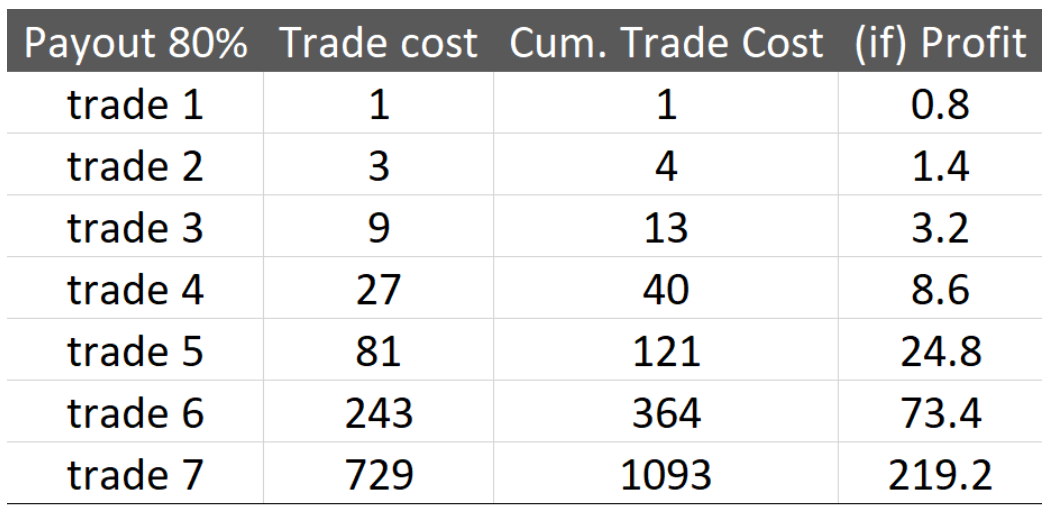

Even if you lose, the Martingale approach requires you to up your wager. In other words, if you lose a trade, you should invest a multiple of your loss in the subsequent deal. Increase your investment if you continue to lose until you find a trade that works. Once you make a profitable trade, start over with the small beginning commitment.

How does the Martingale Technique operate? Why would you raise your wager even after losing? Martingale proponents contend that a winning transaction will eventually be able to make up for any losses from earlier trades.

See Martingale believers consider trading options to be a form of gambling. There is a 50/50 probability that any deal will succeed or fail. Therefore, it is impossible to have an endless losing run. Most importantly, the likelihood of losing goes down as you placemartingle str more deals.

Can Martingale be practically applied to options trading?

Probability vs psychology

The Martingale approach can be successful in options trading if you look at it from a probabilistic perspective. There is a 50/50 probability that any deal will succeed or fail. Hence, losing numerous successive deals is improbable.

Each deal has a 50/50 chance of success or failure. Yet, from a psychological perspective, this method is perhaps the worst money management plan for an options trader.

Nobody desires financial loss. And while a trader may feel at ease losing modest sums in the first few trades, dread may develop as the losses rise.

On the other hand, a trader might be inspired if they win their first few trades. The profits made by the modest winners, however, could be completely erased by a single catastrophic loss in ensuing deals.

Long term profitability isn’t possible

You will require access to enormous sums of money in order for the Martingale method to be successful. Even then, you depend on the profitable trades to make up for the unsuccessful ones. At first, you might have made profitable trades.

But in the future, one unsuccessful trade might wipe out a sizable portion of your account balance. On the other side, a profitable trade might make up for a losing one. The remaining return, though, could not be enough to offset your substantial investment in that single deal.

There’s no guarantee that you’ll eventually hit a winning trade

Martingale proponents contend that there is no way to achieve an endless string of losing transactions, but it is still conceivable to incur so many losses that your account is completely exhausted.

without making a profitable trade. Even if you place a successful trade, it could not be sufficient to make up for prior losses, leaving your account in the red. You might notice that your account is gradually being used down until it is wiped out over time.

Your first objective as a trader is to safeguard your money

Your main goal as a trader is to protect your capital. When you trade options, you invest your own money in an effort to gain profit. You don’t want to get broke.

The consensus among many great traders is that you must first protect your current assets in order to gain money. The Martingale strategy, on the other hand, suggests placing a sizable wager in the hopes of eventually winning money.

In the end, you can decide to stake your entire account on a single unsuccessful trade that causes your account to be wiped out.

Can you apply the Martingale strategy to trade in your Quotex account?

Let’s say you decide to apply the Martingale technique after spotting a decline. A 5-minute time period is represented by each candle. You choose to place sell transactions for two minutes.

Your approach might entail putting sell transactions for three consecutive bearish candles, then watching to see if they result in profitable trades or not. You can increase your trading amount on three additional sell trades if they all succeed.

Martingale technique The plan might be effective in theory. You cannot, however, foresee how the market will develop in the future. An incident or news report may cause the trend to abruptly change.

You can lose all the money you invested in one trade due to a single market move. Ultimately, using the Martingale technique to trade options entails a great deal of risk.

Tips for applying the Martingale strategy to options trading

It’s not hard to use the Martingale method in your Quotex account. Instead of mindlessly putting more money at risk with each transaction, you can instead adopt a straightforward trading strategy. It proceeds as follows.

Have a set amount you’ll trade for a specific cycle

You can choose to only spend a tiny fraction of your account balance rather than continually increasing the trading amount. For illustration, you might choose to stake no more than $200 in a single trading cycle.

For the first exchange, you will receive $50, for the second, $70, and for the third, $80. Keep in mind that the $200 represents a small portion of your entire account amount. Also, you’ll only trade with this sum till it runs out.

Decide on a maximum trade size every cycle. If you’re wondering what I mean by a cycle, it’s a predetermined period of time. For instance, you might choose to trade three bearish candles in a downtrend.

The likelihood of the trend changing when the price enters a cycle is a characteristic of cycles. You are unsure about the exact timing of this, though. Hence, your goal is to profit as much as you can by riding the cycle until the trend eventually changes.

For instance, you might anticipate a range, reversal, or breakthrough if the price reaches the support or resistance level. Just when, you don’t know. Nevertheless, now that you’ve located the resistance/support level, you may test the market direction using the Martingale strategy.

The modest sums involved could lead to lost deals. But by the time you’re making bigger bets, you’ll know which way the market is going.

You can use the Martingale system for longer trades

The Martingale approach can be helpful if you like to stay in one posture for a longer period of time. You have the option to trade three times a day: in the morning, the afternoon, and the evening.

Martingale is used for longer positions. The morning trade will mostly be used to test the markets, therefore it will require less money.

The trading session in the afternoon is utilized to validate market trends. You can enter the evening trade the same manner you did the morning and afternoon transactions if both of them succeed.

There are various benefits to this tactic. One benefit is that you have more time to research the markets based on how well your trades performed. Second, you can use tiny amounts to test the market’s direction. Your chances of making a profitable trade are raised in this manner.

Even while I don’t suggest utilizing the Martingale technique, it has advantages. Use it only if you have a sound money management plan (no one should ever risk a large portion of their account on a single trade).

Also, this method requires flexibility since without it, you risk losing all of your money on an one trade.

FAQS

Q: What is the Martingale strategy?

A: The Martingale strategy is a betting system that involves doubling your previous bet after a loss in an attempt to recoup your losses and make a profit. The idea behind the strategy is that, eventually, you will win a bet and make up for all your previous losses.

Q: Can Quotex traders use the Martingale strategy?

A: While it is technically possible for Quotex traders to use the Martingale strategy, it is generally not recommended. This is because the Martingale strategy assumes that you have an infinite amount of money to continue doubling your bets, which is not the case for most traders. Additionally, there is always the risk of a losing streak that could wipe out your entire account.

Q: Are there any risks associated with using the Martingale strategy?

A: Yes, there are several risks associated with using the Martingale strategy. The main risk is that you could experience a long losing streak that could wipe out your entire account if you do not have enough capital to continue doubling your bets. Additionally, the Martingale strategy assumes that the odds of winning are always in your favor, which is not always the case in the financial markets.

Q: What are some alternative strategies for managing money in Quotex trading?

A: There are several alternative strategies that traders can use to manage their money in Quotex trading. One popular strategy is to use a fixed percentage risk per trade, which involves risking a set percentage of your account on each trade. Another strategy is to use a stop loss order to limit your losses on any one trade. Ultimately, the best strategy will depend on your individual trading style and risk tolerance.